News/Canada

OECTA reaches tentative deal with province, avoiding conflict to begin school year

By Evan Boudreau, The Catholic RegisterTORONTO - Catholic school teachers, trustees and the provincial government have come to a tentative contract agreement just days before the start of the new school year.

CWL calls for notwithstanding clause

By Catholic Register StaffThe Catholic Women’s League of Canada has called on the federal government to invoke the notwithstanding clause to block implementation of physician-assisted suicide.

Cardinal Collins marks 400 years since first Mass in Ontario

By Andrew Philips, Catholic Register SpecialLAFONTAINE, Ont. - Four centuries ago, the first Mass west of Quebec was celebrated in the Huron-Wendat village of Carhagouha. On Aug. 15, Toronto's Cardinal Thomas Collins returned to that spot to mark the 400th anniversary of the event.

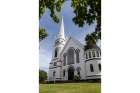

Anonymous donor to the rescue of P.E.I. parish

By Evan Boudreau, The Catholic RegisterA recently launched capital campaign at St. Malachy’s Church on Prince Edward Island is getting a helping hand from outside the parish community.

Pan Am trafficking project a resounding success

By Evan Boudreau, The Catholic RegisterTORONTO - Organizers of the Gift Box campaign set up during the Pan Am and Parapan Am Games in Toronto to raise awareness of human trafficking have exceeded their expectations, volunteers say.

Harper promises funds in support of religious freedom

By Deborah Gyapong, Canadian Catholic NewsOTTAWA - Prime Minister Stephen Harper has pledged continued support for religious freedom, promising $9 million to help persecuted religious minorities.

Iraq’s Christians still in dire need of help

By Deborah Gyapong, Canadian Catholic NewsOTTAWA - One year after the Islamic State’s invasion of Iraq forced more than 120,000 Iraqi Christians to flee ancient homelands with little except their clothes, most continue to live in poverty and chaos.

If God’s house is divided, it’s headed for ruin

By Deborah Gyapong, Canadian Catholic NewsOTTAWA - To win the world for Jesus Christ, Christians must overcome divisions among themselves, Franciscan Father Dmitri Sala told the Fire and Fusion Conference here Aug. 6.

Protecting the environment goes beyond climate change

By Michael Swan, The Catholic RegisterWhether motivated by Canadian garbage, Canadian mines or devastating typhoons linked to global warming, Pope Francis’ environmental encyclical has emboldened the fight in the Philippines for environmental justice, said an advisor to the Catholic Bishops’ Conference of the Philippines.

Pope creates exarchate for Syro-Malabar Catholics in Canada

By Catholic News ServiceVATICAN CITY - Pope Francis has established an apostolic exarchate, the precursor to a diocese, for Syro-Malabar Catholics in Canada and has named their current Toronto-based chaplain, Fr. Jose Kalluvelil, a bishop and head of the exarchate.

Synod’s task is to open hearts to Church views on family

By Michael Swan, The Catholic RegisterPope Francis is asking for prayers and hoping for miracles ahead of this October’s Synod on the Family.